Visium Technologies, Inc. (OTCMKTS:VISM)

(d.b.a. Visium Analytics)

We are kicking off coverage of another exciting new play with yet another special report this morning. For those who may not recall, earlier this month, we featured reports on an OTC nanotech play which subsequently ran 130% from .05-.116 in a matter of weeks.

Today we are introducing our readers to VISM, a Virginia-based data analytics and cybersecurity firm. Like our recent successful pick, VISM has technical upside potential which we will get into in just a moment- but also has solid substance and a technology partnership with a NASDAQ-traded company that is well known to us. So one thing we want to do is examine VISM‘s connection with Nutanix, Inc. (NASDAQ:NTNX) a little further before delving into what we like about the actual chart.

______

NTNX PARTNERSHIP:

Nutanix is a leader in the field of hyper converged infrastructures (HCI) and enterprise cloud computing. The company has formed a strategic technology partnership with VISM to provide enhanced cybersecurity visibility and remediation through Visium’s CyGraph technology, which we’ll detail in the next section.

NTNX is well known to us, having appeared in our morning reports on many occasions in the past, as you can see with a quick tag search of our archives. VISM also has other strategic alliances that you can read about in more detail at this page.

This morning’s fresh new release, which you’ll find further down the page hints an even further expansion of the relationship between the two companies.

______

VISM TECHNOLOGY:

CyGraph is a cutting-edge data analytics and visualization platform with a cybersecurity focus, that delivers:

- Asset profile collection, tracking and telemetry, in real-time.

- Intuitive maps and topologies of the infrastructure (white board approved!).

- A real-time root causal analysis engine and visualizer.

- Predictive and visual event warnings – for paths & assets.

- Cyber health scoring system in compliance with standard CVE & CVSS metrics.

- Universal data ingestion engine, delivering a single view of the enterprise using data received from disparate cyber and system management tools.>>More CyGraph Info HERE…

______

VISM CHART

It’s not just the company’s technology and vision that interests us. In terms of technical attractiveness, VISM boasts the same type of high subpenny-low penny volatility that can make a trader’s day, week, or month!

The stock had been flirting with the subpenny to penny barrier for the past several weeks, and only just this week has it begun to make a more convincing push into Pennyland- just yesterday, it reached a high of .016. Volume has been on the rise as well.

From VISM‘s closing price of .007, a return to yesterday’s highs could come close to or exceed triple-digit percentage gains. Were the stock to find its way back to the highs it saw in August, we would be talking about a far more considerable upswing! We are certainly coming across this play at a potentially opportune moment, and highly suggest our readers follow our continuing coverage of VISM.

______

TODAY’S VISM NEWS:

FAIRFAX, VA, Oct. 30, 2019 (GLOBE NEWSWIRE) — Visium Technologies, Inc. (OTC: VISM), a provider of big data analytics visualization for cybersecurity, and a Nutanix technology partner, announced today that it successfully unveiled its flagship product, CyGraph, at the .NEXT conference in Copenhagen, Denmark. Visium was the sole big data analytics/cybersecurity sponsor at the conference, which was hosted by Nutanix and featured more than 4,000 attendees from around the world. The event generated numerous customer leads and technology partnership opportunities for Visium. Additionally, Visium further engaged with Nutanix in development efforts to incorporate CyGraph into the Nutanix suite of security tools. (>>VIEW FULL PR)

______

For more info on VISM, reply directly to this email, and/or visit

visiumtechnologies.com

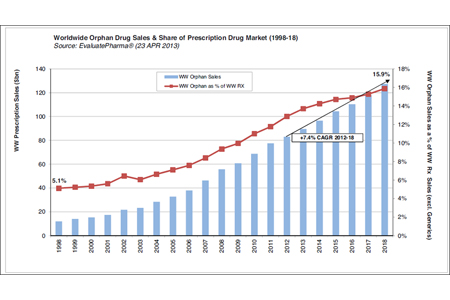

Since the Orphan Drug Act was passed in 1983, the global market for development of drugs used to treat rare diseases has skyrocketed. At that time, drug therapies for such diseases were rarely developed. That has changed in today's multi-billion dollar market.

Since the Orphan Drug Act was passed in 1983, the global market for development of drugs used to treat rare diseases has skyrocketed. At that time, drug therapies for such diseases were rarely developed. That has changed in today's multi-billion dollar market.