Principal Solar, Inc.(OTCMKTS:PSWW) – Special Report:

Principal Solar, Inc.(OTCMKTS:PSWW) – Special Report:

As we mentioned in yesterday morning’s report, we are excited to be bringing a new item of interest to our readers’ attention this morning. With both the monetary and environmental costs of powering our increasingly demanding lives rising consistently, we believe it’s high time for a renewed interest in cleaner and more sustainable energy sources. That is one of the philosophies of the company that we are focusing upon today.

Principal Solar (PSWW) invests in, and/or acquires companies and technologies focused upon the next phase in consumer and commercial energy supply. Sustainability is the clear answer for a stable future, and renewable, clean energy will only continue to become more vital to our everyday lives, even as we continue to be, at least in part, reliant on more traditional sources.

For example, we are living in an age where most major automakers have acknowledged that fossil fuel will largely become a thing of the past well inside the next two decades. Take Cadillac for instance, which is no longer making new ICE models, and expects to be conducting all-EV sales by 2030. What that signifies to the rest of us, is that the times are certainly changing, and so must our consideration of energy related investment for the future.

PSWW also recognizes this, and has itself been strategically investing accordingly. For instance, in the past two years the company has taken a large stake in eTruck Transportation, on the order of more than a million dollars. The company recently posted a video presentation of eTruck’s production facilities, providing a look at its upcoming line of fully-electric Class 6 and Class 8 cargo vehicles. (>>Click Here to View the Walkthrough)

Committed to diversification, PSWW also seeks traditional energy opportunities, and has recently executed a letter of intent to purchase a controlling working interest in the leases, wells, and assets on the Minerva-Rockdale Oil Field (Milam County, Texas) from Winchester Oil & Gas LLC. A recent engineer’s report indicated proven reserves of more than 4 million barrels, with a current market value of well over a hundred million dollars. (>>View Press Announcement)

In addition to having these, and a number of other interests, PSWW itself has been rising steadily over the last month, with more than enough room for further upside potential. This is yet another factor drawing our attention to this intriguing opportunity to get in on the ground floor of a lot of of exciting developments.

Be sure to stay tuned to our reports on PSWW where we’ll dive even deeper on this high-potential stock in the weeks ahead, and continue below for our present opinion on the PSWW chart.

_____

PSWW CHART:

The setup of the current PSWW chart is exhibiting many of the classic signs of a high-potential momentum play. We’ve had a lot of experience in reading OTC charts, and this one has been seriously ripening over the past month. With an RSI barreling into the Power Zone, and a MACD which had a bullish cross earlier this month and continues to diverge, we are excited to see the kind of conditions that even more upward pressure could create.

For More Information on PSWW, Please Visit:

pswwenergy.com

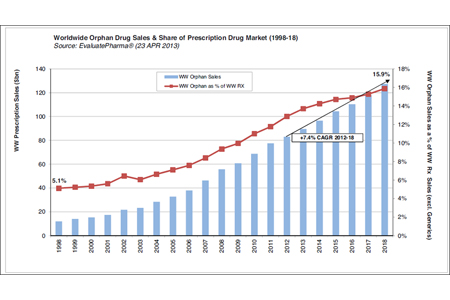

Since the Orphan Drug Act was passed in 1983, the global market for development of drugs used to treat rare diseases has skyrocketed. At that time, drug therapies for such diseases were rarely developed. That has changed in today's multi-billion dollar market.

Since the Orphan Drug Act was passed in 1983, the global market for development of drugs used to treat rare diseases has skyrocketed. At that time, drug therapies for such diseases were rarely developed. That has changed in today's multi-billion dollar market.